Digido offers digital loans, aiming to provide convenient and accessible financial solutions in the Philippines. In this article, we analyze the pros and cons, key features, loan types, interest rates, requirements, repayment methods, exclusive features, customer support, mobile app functionality, account creation process, and suitability for different borrower profiles.

Pros and Cons of Digido

Pros:

- Convenience: Digido Philippines offers a convenient online platform for loan applications, eliminating the need for physical visits to financial institutions.

- Accessibility: It provides online lending services, increasing accessibility to a wider range of individuals.

- Fast Approval: The loan application process is generally faster compared to traditional lending institutions.

Cons:

- High Interest Rate: Like other online lending platforms, Digido may charge a higher interest rate.

- Potential Debt Cycle: Borrowers may fall into a debt cycle if loans are not managed responsibly.

- Limited Payment Options: Digido’s payment options could be restricted.

Key Points

Digido is a reputable Philippine online lending platform offering:

- Features: Adjustable credit limits, individualized loan amounts, practical repayment choices, and responsive customer care.

- Loan Details: Interest rate ranging from 0% to 11.9%, loan amount from PHP 1,000 to PHP 50,000, and loan tenure from 3 to 12 months.

- Approval Time: Within 24 hours with no processing fee.

Full Review

Digido Online is a legit lending platform offering hassle-free cash loans in the Philippines with transparent terms and quick approvals. It encourages responsible borrowing and provides a trustworthy solution for individuals seeking efficient cash loan services.

What is Digido?

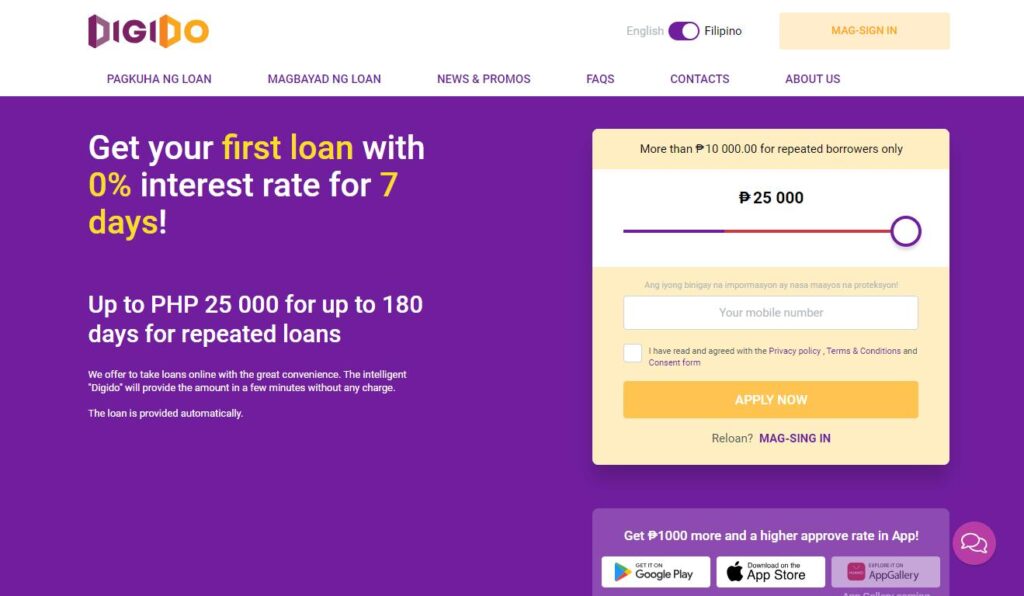

Digido is a leading financial company in the Philippines, offering a convenient online platform for loan applications without the need for physical visits to banks. It provides personalized loan amounts and flexible payment options.

Loan Types Provided by Digido

Digido offers various online loan types, including personal loans, salary loans, and emergency loans, catering to different financial needs without requiring borrowers to leave their homes.

Interest Rate for Digido

Digido’s interest rate varies based on factors such as creditworthiness and repayment tenure, with rates ranging from 0% to 11.9%. Maintaining a good credit history may lead to more favorable rates.

Digido Cash Loan Requirements

Digido has specific loan requirements, including age verification, proof of identification, income verification, residence confirmation, and employment details.

ID’s accepted by Digido

Digido accepts various IDs for verification, including the PhilSys ID and Unified Multi-Purpose ID (UMID).

How Can You Repay a Loan in Digido?

Digido offers multiple repayment methods, including online financing, debit card payments, over-the-counter payments, and mobile apps, providing flexibility and convenience for borrowers.

Exclusive Features of Digido

Digido offers unique features such as dynamic credit boundaries, personalized loan amounts, expedited approval and disbursal, and a user-friendly digital platform.

Digido Customer Support

Digido provides dependable customer service via phone and online form, offering timely assistance for managing loans and addressing borrower concerns.

Digido Mobile App Review

The Digido mobile app provides a user-friendly interface for loan requests and management, enabling borrowers to apply for loans, track progress, and manage repayments conveniently.

How Does the Digido App Work?

The Digido app streamlines the loan request process, allowing borrowers to register, submit applications, upload documents, and track progress easily.

How do I Create a Digido Account?

Creating a Digido account is simple and involves downloading the app, registering, providing necessary details, verifying information, and completing personal information.

Whom Digido Suits Better?

Digido is suitable for individuals needing quick and convenient access to online loans, including students, small business owners, and those in need of immediate financial assistance.

Frequently Asked Questions

- Is Digido legally operating in the Philippines? Certainly, Digido is a legitimate online lending platform. Digido Philippines is registered with the Securities and Exchange Commission (SEC) and holds certifications.

- Can I make advance payments on Digido? Absolutely, advance payments on your Digido loan are permissible. This proactive approach can help diminish your outstanding balance and potentially reduce interest charges.

- How can I update my information on Digido? To modify your details on Digido, simply log in to your account and navigate to ‘Settings.’ From there, you’ll find options to edit and update your personal information.

- What’s the process for approval on Digido? For loan approval, ensure you accurately complete the application process and provide the required supporting documents, such as proof of income and employment records.

- What’s the maximum credit limit on Digido? The maximum credit limit varies based on individual factors like creditworthiness, income, and repayment history. It can range from 1,000 PHP to 25,000 PHP.

Digido Loan Competitors

| Company | Loan Amount (PHP) | Interest Rate | Loan Term |

|---|---|---|---|

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days |

| CashMart | 3,000 – 150,000 | 0.8% to 3.5% | Up to 6 months |

| EasyCash | 5,000 – 25,000 | 0.33% – 1% | 1 to 300 days |

| Crezu | 1,000 – 25,000 | 1.5% per month – 30% per year | 3 to 12 months |

| CashMe | 2,000 – 20,000 | 0.08% per day | Up to 3 months |

| Blend | 50,000 – 2 million | 1.5% to 3% monthly | Up to 36 months |

| Binixo | 2,000 – 30,000 | 1% per day | 7 to 30 days |

| Asteria Lending Inc | 2,000 – 50,000 | 0.2% per day | 30 to 120 days |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days |

| GCash | 5,000 – 25,000 | 3% to 15% | 15 to 90 days |

| CashBee | 2,000 – 20,000 | 0.3% daily | 30 to 120 days |

| Revi Credit Philippines | 1,000 – 250,000 | 1% – 5% | 6 to 36 months |

| Tala | 1,000 – 25,000 | 15% – 15.7% | 15 to 61 days |

| Vamo | 1,000 – 30,000 | From 1.3% | 10 to 3000 days |

| Flexi Finance | Up to 25,000 | 365 to 1460 days | |

| JuanHand | Up to 50,000 | 14.7% per month | 14 to 90 days |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | 180 to 365 days |

| RoboCash | 1,000 – 25,000 | 0% to 11.9% | Up to 30 days |